Nigeria faces mounting fiscal and economic pressures as the International Monetary Fund (IMF) projects lower oil prices and rising inflation, challenging the assumptions behind the Federal Government’s N55 trillion budget.

In its latest World Economic Outlook (WEO) released at the Spring Meetings in Washington, DC, the IMF forecasts average crude oil prices at $66.94 per barrel in 2024, falling further to $62.38 in 2025 — a stark contrast to Nigeria’s optimistic $75 benchmark in the 2024 budget.

These projections could drastically undermine Nigeria’s revenue expectations, prompting calls for urgent fiscal reforms, spending cuts, and accelerated non-oil revenue mobilisation.

Growth Downgrade and Inflation Surge

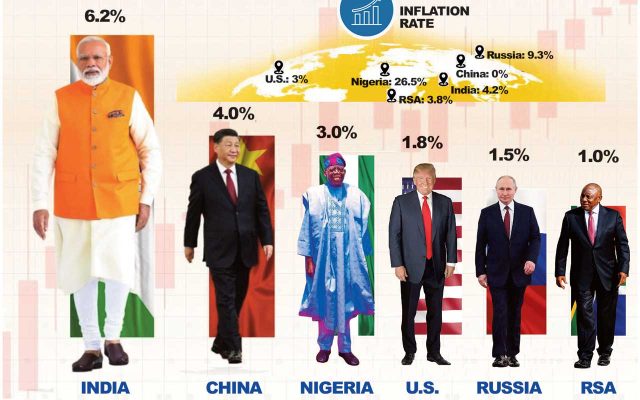

The IMF also revised Nigeria’s economic growth forecast downward to 3% in 2025, 0.2 percentage points below previous estimates, and projected inflation to rise to a staggering 37% next year, from an average of 26.4% in 2024.

These warnings come amid persistent fiscal imbalances, ballooning money supply exceeding N110 trillion, and limited impact of recent reforms on poverty and food security.

“Gains have yet to benefit all Nigerians as poverty and food insecurity remain high,” the IMF said, noting that while key reforms like fuel subsidy removal and forex liberalization are commendable, macroeconomic gains remain fragile.

Experts Sound Alarm on Budget Sustainability

Tolulope Alayande, an investment banker, criticised the government’s $74 oil price assumption as unrealistic, citing both global economic trends and Nigeria’s underperformance in oil production, which currently averages 1.3–1.4 million barrels per day — well below the 1.78 million barrels projected in the budget.

He and other analysts argue that cutting government expenditure is critical, urging implementation of the Oronsaye Report to streamline ministries, departments, and agencies.

Calls for Structural and Fiscal Reforms

Muda Yusuf, CEO of the Centre for the Promotion of Private Enterprises (CPPE), warned that a combination of lower oil prices and production shortfalls could derail the fiscal framework and worsen public debt. He advocated for:

Aligning expenditure with actual revenue

Prioritising essential and economically impactful projects

Scaling non-oil revenues through tax reforms

Dr. Paul Uzum of Hallo Capital Management emphasized a two-pronged strategy:

Short-term austerity — reduce capital spending and cut wastage

Long-term diversification — grow sectors like agriculture, manufacturing, and mining to reduce dependence on crude oil

He also proposed raising import duties on luxury goods to boost revenue and conserve forex, while increasing oil export volumes to offset price declines.

Policy Recommendations and IMF Advice

The IMF underscored the need for a tight monetary policy to rein in inflation and recommended a neutral fiscal stance to complement monetary tightening. It also urged that savings from fuel subsidy removal be directed toward targeted social programs, especially for food-insecure households.

“Announcing a disinflation path to serve as an intermediate target can help anchor inflation expectations,” the IMF said.

The Bigger Picture

Nigeria’s ambition to transform into a $1 trillion economy over the next five years hinges on sustained double-digit growth and currency stability — both increasingly out of reach amid global and domestic headwinds.

With elections looming and political pressures rising, experts warn that only disciplined economic management, bold reforms, and realistic revenue strategies can prevent a deeper fiscal crisis.