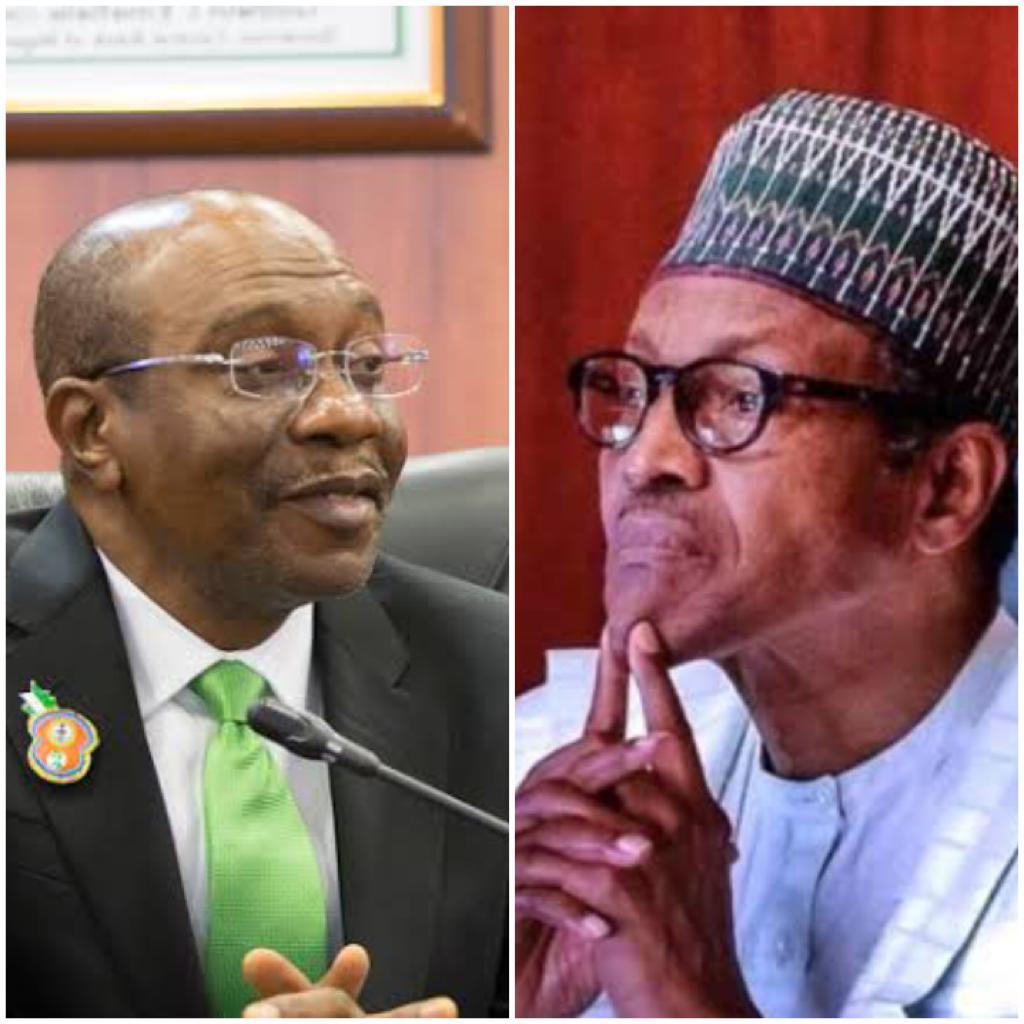

Data available from the Central Bank of Nigeria (CBN) shows that the Federal Government has borrowed N3.15 trillion from the apex bank in the first seven months of 2022.

The Federal Government showed no signs of putting the brakes on its recourse to the CBN last month, borrowing N695 billion in July which raised the total debt at the end of the month to N20.61 trillion.

Several economists in the country as well as the World Bank and the International Monetary Fund (IMF) have raised the alarm over the Nigerian government’s continued reliance on CBN financing.

The debt owed by the Federal Government to the central bank is currently not included in the country’s public debt stock, which rose by N2.04 trillion in the first quarter of this year to N41.60 trillion, according to the Debt Management Office (DMO).

“Other countries are not ready to lend Nigeria money because we already owe a lot of money. So, the last resort is to go to the CBN. The borrowing from the CBN is not tied to any production; so it is very inflationary,” a professor of Economics at the Olabisi Onabanjo University, Ogun State, Sheriffdeen Tella, told BusinessDay.

“We have been warning all this while. Even the World Bank and IMF have also warned. We have told them a long time ago that they are not supposed to be looking at debt in relation to the GDP but to the revenue. Revenue is not rising and then you are borrowing money,” he added.

The World Bank, in its latest Nigeria Development Update (NDU) report released in June, said amid heightened risks, the government had kept a “business-as-usual” policy stance that hindered prospects for economic growth and job creation.

It said financing of the fiscal deficit and trade restrictions by the central bank continued fuelling inflationary pressures in the country.

Inflation surged to 19.64 percent in July, the highest in almost 17 years, undercutting purchasing power as Nigerians are facing higher prices for virtually everything from food to gas to rent.

“Multiple exchange rates, trade restrictions, and financing of the public deficit by the Central Bank of Nigeria continue to undermine the business environment. These policies augment long-standing weaknesses in revenue mobilisation, foreign investment, human capital development, infrastructure investment, and governance,” the World Bank said.

CBN loans to the Federal Government through the Ways and Means Advances surged by N4.34 trillion last year to N17.45 trillion in December.

Ways and Means Advances is a loan facility used by the central bank to finance the government in periods of temporary budget shortfalls subject to limits imposed by law.

The total amount of such advances outstanding shall not at any time exceed five percent of the previous year’s actual revenue of the Federal Government, according to Section 38 of the CBN Act, 2007.

“All advances shall be repaid as soon as possible and shall, in any event, be repayable by the end of the Federal Government financial year in which they are granted and if such advances remain unpaid at the end of the year, the power of the bank to grant such further advances in any subsequent year shall not be exercisable, unless the outstanding advances have been repaid,” it says.