The Nigerian government has been advised to reduce its borrowings from the Central Bank of Nigeria (CBN) for funding the budget deficits.

In a statement issued on Wednesday, the rating agency said the constant running to the apex bank to get funds “could raise risks to macroeconomic stability.”

Just like others in the emerging economies, the fiscal authorities in Nigeria approached the central bank to finance their spending last year because of the COVID-19 pandemic, which brought the world to its knees.

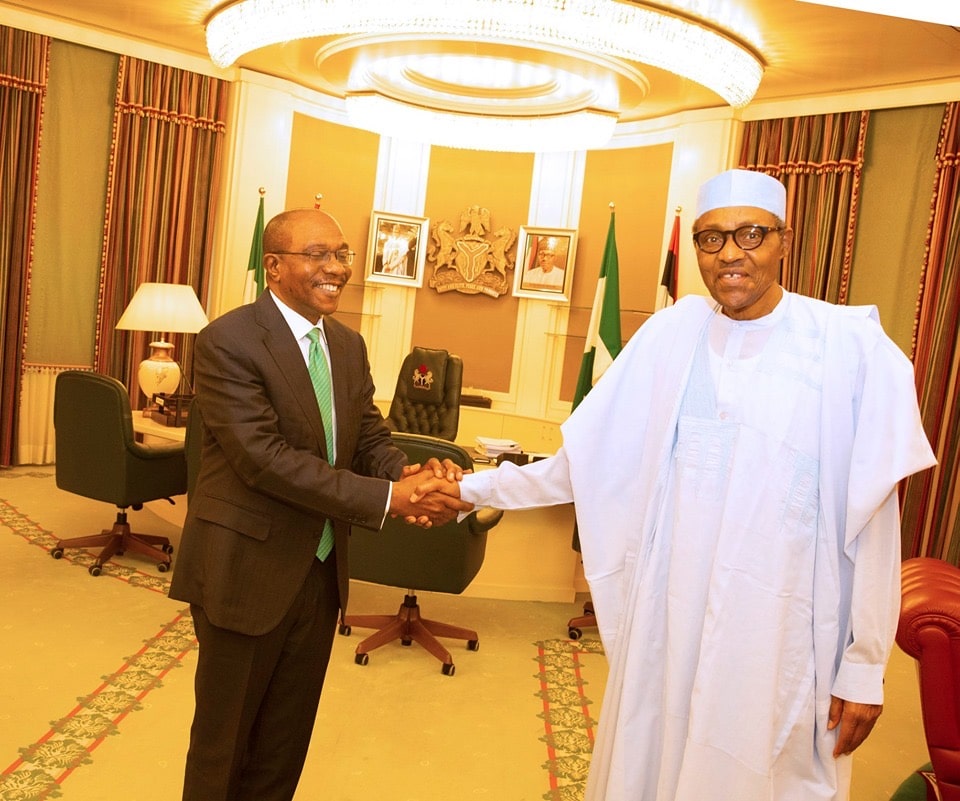

The federal government “directly borrowed 1.9 per cent” of the nation’s Gross Domestic Product (GDP) from Mr Godwin Emefiele’s-led CBN in 2020.

These funds were used by the government finance the 2020 budget deficit and Fitch said it believes that the balance of the government in the Ways and Means facility (WMF) domiciled with the CBN stands around N9.8 trillion, which is 6.7 per cent of GDP at end-2019.

“Unlike the government, we include this balance in our metrics for Nigeria’s government debt. Borrowing from the facility accounted for 30 per cent of the FGN’s debt at end-2019, on our estimates,” the agency noted.

Fitch warned Nigeria to reduce its use of the facility in 2021 because of its weaknesses in public finance management and the current weak institutional safeguards.

It said normally, the limit for the use of the WMF facility by the government should be 5 per cent of the previous year’s fiscal revenues, but the recent borrowing from the “CBN has repeatedly exceeded that limit in recent years, and reached around 80 per cent of the FGN’s 2019 revenues in 2020.”

In the statement, Fitch said it “views the Nigerian government’s fiscal revenue and expenditure projections for 2021 as broadly realistic, which should preclude further significant borrowing by the sovereign from the CBN facility this year.

“The government may nonetheless use the facility more extensively if the deficit proves wider than forecast or if external financing falls short of planned amounts.

“Monetary financing of the fiscal deficit raises challenges to monetary policy implementation, as tight management of domestic liquidity is a key tool under the CBN’s policy of prioritising the stability of the naira. It could also complicate official efforts to bring inflation back under control.”

A few days ago, the National Bureau of Statistics (NBS) said inflation in Nigeria went higher to 15.75 per cent in December 2020 and according to Fitch, this is “a credit weakness.”

Source: BusinessPost