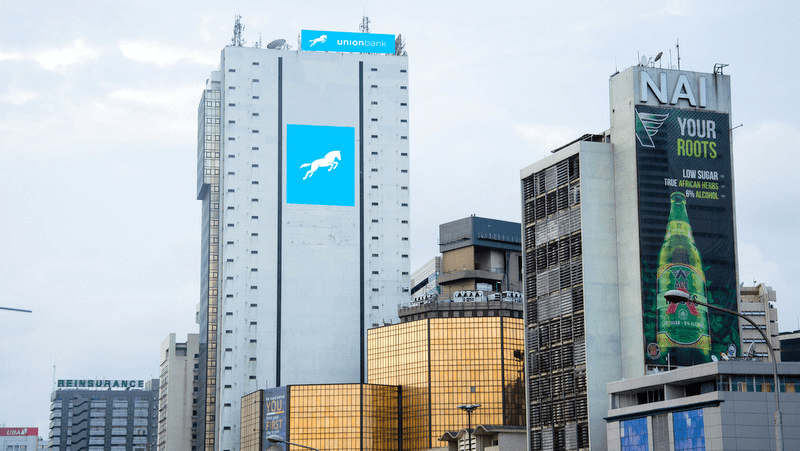

Titan Trust Bank has announced a takeover of one of Nigeria’s oldest banks, Union Bank.

Titan Trust Bank Limited, one of Nigeria’s newest commercial banks, which commenced operations in October 2019, is buying 89.39 per cent of the issued capital of Union Bank, both companies announced Thursday.

“The Board of Directors of Union Bank of Nigeria Plc (“Union Bank”) today announced that it has received a notification from Union Global Partners Ltd. (“UGPL”, the holder of majority shareholding in Union Bank) of the execution of a Share Sale and Purchase Agreement between UGPL, certain other existing shareholders of Union Bank (as Sellers) and Titan Trust Bank Limited (as Purchaser) for the sale of an aggregate 89.39% of the issued share capital of Union Bank held by the Sellers, to the Purchaser (“the Transaction”),” they announced.

The completion of the transaction is subject to obtaining applicable regulatory approvals and the “fulfilment of certain conditions precedent”.

Commenting on the transaction, the chairperson of Union Bank, Beatrice Bassey said: “On behalf of the Board, we congratulate all the parties involved in reaching this phase of the transaction and the Board looks forward to supporting the next steps to ensure a seamless completion of the process following regulatory approvals. We are grateful to our current investors whose significant and consequential investments over the past nine years facilitated the transformation of Union Bank, one of Nigeria’s oldest and storied institutions. Today, the Bank is well-positioned with an innovative product offering, a growing customer base of over six million and consistent year on year profitability. This is a solid foundation for our incoming investors to build on as we move into a new era for the Bank.”

The chairperson of Titan Trust Bank, Tunde Lemo, said: “The Board of Titan Trust Bank and our key stakeholders are delighted as this transaction marks a key step for Titan Trust in its strategic growth journey and propels the institution to the next level in the Nigerian banking sector. The deal represents a unique opportunity to combine Union Bank’s longstanding and leading banking franchise with TTB’s innovation-led model which promises to enhance the product and service offering for our combined valued customers.”

The Chief Executive Officer of Union Bank, Emeka Okonkwo, said: “This transaction marks a significant milestone in the journey of our 104-year old Bank. Whilst thanking our current investors for their unwavering commitment to the Bank over the years, we welcome our new core investor, TTB. We recognize thestrategic fit between the two institutions and expect that this deal will deliver the best outcome for our employees, customers and stakeholders. We look forward to collectively writing the next exciting chapter for Union Bank.”

Also the Chief Executive Officer of Titan Trust Bank, Mudassir Amray, said: “After completing over two years of operations with aggressive organic growth, we are excited to have an opportunity for a significant leap forward in market share. UBN’s widespread presence, state of the art technology platform, quality staff and strong brand loyalty fits well with our synchronized modular strategy. We look forward to delivering superior results for the benefit of our staff, customers, shareholders, and stakeholders.”

Union Bank of Nigeria was established in 1917 and listed on the Nigerian Stock Exchange in 1971.

The bank has a network of over 280 sales and service centres across Nigeria.