UK house prices increased 0.2% in June, with the market stabilizing in anticipation of lower interest rates.

The monthly growth, which takes into account seasonal effects, has taken the average price of a house in the country to £266,064.

Nationwide’s House Price Index also showed the increase had resulted in the annual rate of growth rising from 1.3% in May to 1.5% in June.

Michelle Stevens, mortgage expert at finder.com, said the market “seems to be stabilising in anticipation of lower rates on the horizon” after the Bank of England’s recent decision to hold interest rates.

Maeve Ward, head of intermediary sales at Together, speculated that, on the back of the Bank’s decision, many first time byers, home movers and investors who have been waiting “may delay their plans further”.

“However, others may see this as an opportunity; snapping up property deals as some banks cutting their rates,” she said.

REA ALSO: UK Labour to make major housing announcements ‘within a fortnight’ of winning the election

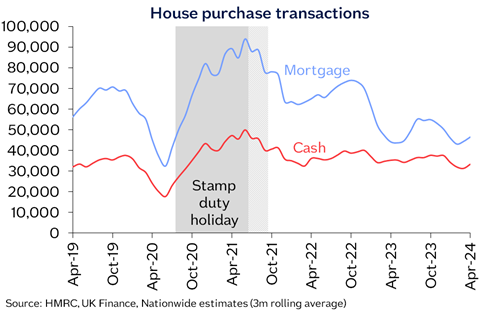

According to Robert Gardner, Nationwide’s chief economist, housing activity has been “broadly flat” over the last year, with the total number of transactions down by around 15% compared with 2019.

By contrast, the volume of cash transactions is around 5% above pre-pandemic levels.

“While earnings growth has been much stronger than house price growth in recent years, this hasn’t been enough to offset the impact of higher mortgage rates, which are still well above the record lows prevailing in 2021 in the wake of the pandemic,” explained Gardner.

“For example, the interest rate on a five-year fixed rate mortgage for a borrower with a 25% deposit was 1.3% in late 2021, but in recent months this has been nearer to 4.7%.

“As a result, housing affordability is still stretched. Today, a borrower earning the average UK income buying a typical first-time buyer property with a 20% deposit would have a monthly mortgage payment equivalent to 37% of take-home pay – well above the long run average of 30%.”

READ ALSO: UK Labour to make major housing announcements ‘within a fortnight’ of winning the election

Stevens suggested that the market could yet be boosted by improved mortgage affordability.

“Although prices only edged up very slightly last month, over the last couple of weeks we’ve seen a few of the major banks reduce their mortgage rates, and this will no doubt help provide a much needed boost to confidence in the housing market,” she said/

“If more banks follow suit, I’m hopeful that this could trigger a price war amongst mortgage lenders, which would be great news for buyers and the millions of people who are due to renew their mortgage this year.”

Northern Ireland experienced the strongest growth during the period, with prices up 4.1% compared with Q2 2023, while prices in East Anglia dropped 1.8%.