- Mortgage rates have dropped thanks to U.S.-Iran tensions.

- This will give a short-term boost to the U.S. housing market.

- But the long-term implications of a potential war could lead to a crash.

Fresh tensions between the U.S. and Iran could give the U.S. housing market a shot in the arm thanks to lower mortgage rates. A flight to the bond market in light of the U.S. bombing of a prominent Iranian general has sent the average rate of the 30-year fixed mortgage to its lowest level in a month.

Quoting Matthew Graham, the Chief Operating Officer of Mortgage News Daily, CNBC reports:

“Treasury yields are falling again thanks to U.S./Iran geopolitical concerns,” said Matthew Graham, chief operating officer of Mortgage News Daily. “Modest gains in MBS will add up to another slight improvement in mortgage rates and thus the 3rd day in a row we can claim the lowest rates in about a month.”

The U.S. Housing Market Gets A Short-Term Boost

This decline in mortgage rates thanks to the heightened tensions and the increasing chances of a full-blown conflict between the U.S. and Iran is proving to be a boon for the U.S. housing market. After all, investors start loading up on safe-haven securities in such times of crisis that could send the stock market into a tailspin.

This has created a scenario of low mortgage rates. Freddie Mac chief economist Sam Khater believes that the U.S. housing market will continue to benefit as a result. He recently wrote in a press release that:

The low mortgage rate environment combined with the red-hot labor market is setting the stage for a continued rise in home sales and home prices.

More importantly, lower mortgage rates could kick-start growth in home sales. The National Association of Realtors had reported last month that existing home sales in the U.S. were down 1.7 percent. That wasn’t surprising as the lack of housing supply had priced buyers out of the market in the U.S.

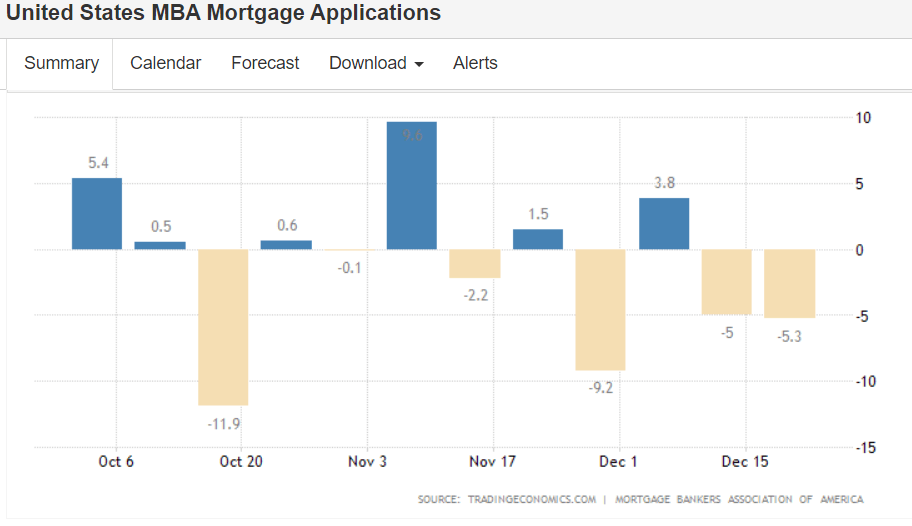

The median price of an existing home in the U.S. housing market increased 5.4 percent year over year in November 2019 to $271,300. Total homes available for sale were down 5.7 percent year over year. This rapid increase in home prices is the reason why mortgage applications have been witnessing a drop over the past couple of months.

At the same time, an increase in mortgage rates was posing a challenge for the U.S. housing market’s growth. But now that mortgage rates are heading south once again thanks to the Iran conflict, buyers can be expected to get into the market with a lot of enthusiasm. But this catalyst isn’t going to be sustainable.

A Protracted Conflict Could Be Dangerous

The U.S. housing market will definitely get a shot in the arm in the short run on account of the Iran conflict. But this is no reason to believe that the good times for the market will continue in case of a full-blown war between the two countries.