President Bola Tinubu has approved the suspension of key provisions in the Financial Reporting Council (Amendment) Act, 2023, following sustained pushback from Nigeria’s organized private sector.

The Act, which reclassified certain large private companies as Public Interest Entities (PIEs), mandated them to pay between 0.02% and 0.05% of their annual turnover as regulatory dues with no upper limit. In contrast, publicly listed companies were required to remit a flat ₦25 million annually, regardless of revenue or size. The disparity sparked significant concern among business leaders, who argued the policy created inequity and risked stifling business growth in a fragile economy.

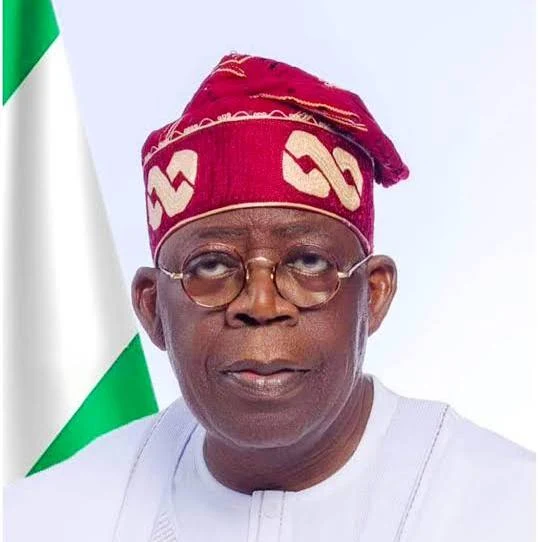

According to the Ministry of Industry, Trade and Investment, the decision to halt the implementation came after months of engagement with stakeholders and the conclusion of a technical review. A formal directive was issued by the Minister, Dr. Jumoke Oduwole, confirming the President’s endorsement of a temporary administrative pause.

“In light of industry feedback and in line with the administration’s commitment to fairness and economic competitiveness, the President has directed a suspension of implementation while a comprehensive review is undertaken,” the statement said.

Dr. Oduwole noted that the Ministry first convened a stakeholder consultation on March 26, 2025, following mounting concerns from industry groups such as the Oil Producers Trade Section (OPTS), the Association of Licensed Telecommunications Operators of Nigeria (ALTON), and the Nigeria Employers’ Consultative Association (NECA). During the engagement, private sector leaders highlighted the potential for increased compliance costs and the risk of reduced investor confidence.

As an immediate response, the Ministry initiated an administrative pause not to exceed 60 days and established a Technical Working Group to evaluate the broader economic implications of Section 33D of the amended Act. The group, made up of representatives from key regulatory and industry bodies, convened six times over a three-week period. A final report was submitted to the Ministry on April 17, 2025.

Following the review, the President has now formalized the suspension. As part of the interim measures, the Financial Reporting Council has been instructed to cap annual dues for private PIEs at ₦25 million the same as for listed companies until further notice.

“This interim directive provides clarity and stability for businesses while reflecting our administration’s focus on transparency, regulatory equity, and investor confidence,” Dr. Oduwole stated.

The Minister added that the Ministry of Justice would assess whether a formal legislative amendment is necessary in the longer term. In the meantime, the pause on implementation will remain in effect for the mid- to long-term, pending a broader review by the National Assembly.

The Financial Reporting Council (Amendment) Act 2023 was originally intended to strengthen financial transparency by expanding oversight to include large privately held firms. However, critics said the move lacked adequate consultation and could create unintended economic burdens.

The policy reversal is being viewed as a significant win for Nigeria’s business community, many of whom warned that unchecked regulatory charges could discourage investment and increase operational pressures amid economic uncertainty.

Dr. Oduwole reaffirmed the Federal Government’s commitment to its 8-Point Agenda, emphasizing economic diversification, job creation, and a stable regulatory environment as key pillars of ongoing reforms.

With the suspension now in effect, further guidance is expected from the Ministry of Justice and the National Assembly in the coming months.