Prices are getting unaffordable from New York to New Zealand.

Housing Gets Dung and Dunger

One point three million U.S. dollars sounds like too many dollars to pay for a house that’s practically falling down, until you consider it’s in the suburb of a major city in a developed country that beat Covid-19, is relatively safe from nuclear fallout, and has a toothbrush fence.

That’s how much an Auckland “dunger,” which is the New Zealandish word for “dump,” sold for in January. If it sold today, it would probably go for more. If I had $1.3 million to spend on a house, the dunger would be mighty tempting because, again, New Zealand. It’s a special place. But it’s far from the only country where home prices are at spit-take levels, writes Lionel Laurent.

Feel the FOMO

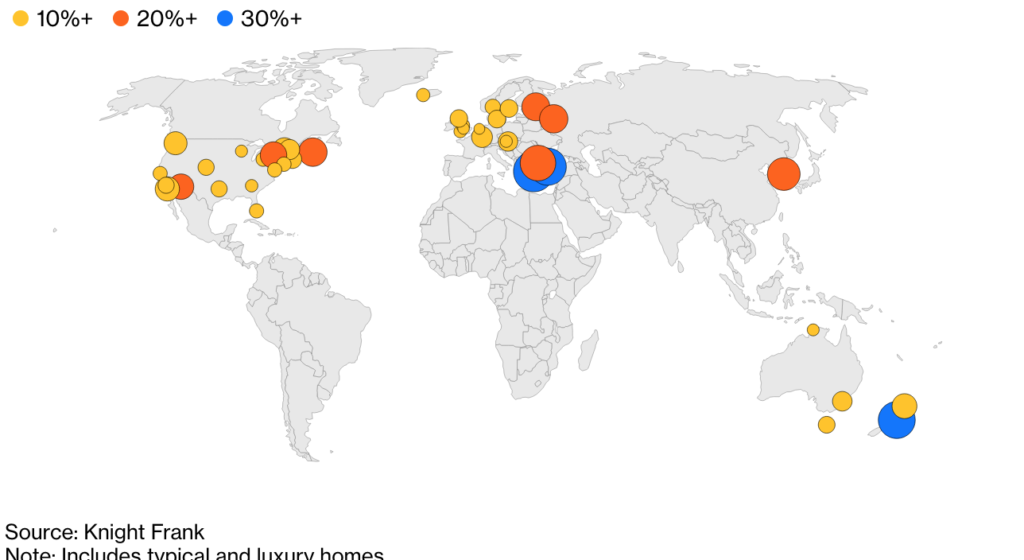

Real-estate prices in 43 cities around the world rose at least 10% between Q1 2020 and Q1 2021

Lionel diagnoses the planet with mass FOMO. Hard-luck millennials finally feel a little flush and want to make up for decades of lost wealth-building time. People see prices going up and naturally want in, assuming prices will go up forever because nobody remembers what happened yesterday, much less a decade ago. All of it is greased by an endless supply of easy money. The Fed is even still buying mortgage-backed securities, though some central bankers are starting to question the point of it.

Some of us with hazy memories of the Afore Times (2008) get antsy about the possible repercussions of such excess. But a global financial crisis isn’t the only possible bad outcome. Unaffordability can worsen inflation and inequality, turning FOMO into something more dangerous.

Antitrust Needs Newer, Sharper Teeth

Critics of Lina Khan’s novel approach to antitrust law say she’s trying to do too much with it, like using a screwdriver to fix your car, flip pancakes and floss your teeth. But Tara Lachapelle points out America’s antitrust laws were made 100 years ago, a time when showing some ankle in a Model T was what passed for TikTok. They’re just no match for the kind of anticompetitive behavior Big Tech has invented since. Worse, they haven’t been enforced well, even against mergers that obviously fit the “consumer harm” standard antitrust traditionalists favor. Something has to change.

Further Big Tech Reading: The Pentagon did the right thing opening up its cloud computing bidding to Amazon. — Tae Kim

The Taming of the Crypto

When something comes along with as much potential for mayhem and moneymaking as crypto, you can bet it will eventually be domesticated. Central banks around the world are working on their own substitutes — though Andy Mukherjee suggests official [Your Country Here] coins may not be necessary, as long as private options solve crypto’s problems.

Congress, in a classic Congress move, isn’t rushing to regulate crypto. But Timothy Massad writes SEC approval of a Bitcoin ETF could accomplish a lot of regulation simply by forcing exchanges and benchmarks to meet higher standards to participate.

Meanwhile, fans of crypto and the crypt-adjacent just keep finding ways to freak out the establishment. Now they’ve gone and built fake stocks to trade on the blockchain, which Nassim Nicholas Taleb accurately suggests is just an update of the “bucket shops” of yore. Aaron Brown argues this is a good thing, actually, and that nobody can stop the masses from occupying this wild territory, however risky it is.

Source: Bloomberg