When President Bola Ahmed Tinubu set up the Presidential Fiscal Policy and Tax Reform Committee (PFPTRC) in July 2023, it was greeted by general ovation as it appeared to many that the age-long grumbling around the country’s tax regime was receiving the attention it deserved.

Speaking at the inauguration of the committee, the president said: “We cannot continue to tax poverty when we are supposed to promote prosperity.”

The expectation from the committee was further heightened when, shortly after its inauguration, it hinted that it was aiming to reduce the number of taxes levied by federal and state governments from more than 60 to fewer than 10.

As work progressed, the committee, in its periodic briefing, informed Nigerians that the National Tax Policy would be replaced by a more comprehensive “National Fiscal Policy on Fair Taxation, Responsible Borrowing and Sustainable Spending,” as part of the PFPTRC’s continuous efforts to restructure Nigeria’s fiscal architecture.

The bills

The new proposal consists of four bills: The Nigerian Tax Administration Bill 2024 HB, number 1756, The Nigerian Revenue Service (Establishment) Bill 2024, number 1757, The Joint Revenue Board of Nigeria (Establishment) Bill 2024 Bill, number HB. 1758, and The Nigerian Tax Bill HB, number 1759.

The bills, according to the committee, are aimed at reforming the Federal Inland Revenue Service (FIRS) in general, create a standard process for the consistent and effective administration of tax laws to promote tax compliance, prevent tax evasion, maximise tax revenue, and create a framework for cooperation between the federal and state revenue authorities, particularly with regard to information sharing.

First sign of anxiety

Trouble started on October 29 this year when the media was awash with reports with headlines such as: “Northern Govs, Emirs, Reject Tax Reform Bills.” This was followed in quick succession by another report with headlines such as: “LND endorses Northern Govs’ Rejection of Tinubu’s Tax Bill.”

In opposing the bill, the League of Northern Democrats) said: “The Forum notes with dismay, the content of the recent tax reform bills forwarded to the National Assembly. The contents of the bills are against the interests of the North and other sub-nationals, especially the proposed amendment to the distribution of Value Added Tax (VAT) to a derivative-based model.

“This is because companies remit VAT using the location of their headquarters and tax office and not where the services and goods are consumed. In view of the foregoing, the Forum unanimously rejects the proposed tax amendments, and calls on members of the National Assembly to oppose any bill that can jeopardise the wellbeing of our people.”

The rejection escalated rapidly, and by November 1, the National Economic Council (NEC), chaired by Vice President Kashim Shettima asked President Tinubu to withdraw the proposed bills.

However, a day later, news broke that the president had rejected the NEC recommendation, urging the group to allow the tax bills continue through the legislative pathways, emphasising that ample opportunity exists for modifications.

VAT as the focal point for disagreement

On Value Added Tax alone, the Nigerian Tax Bill proposes the following fundamental changes: Inclusion of VAT on the Exclusive Legislative List, a review of the sharing formula, fiscalisation and electronic invoicing, full deduction of input VAT on all supplies, including services and assets, zero-rating of more goods, including agriculture, medical and educational and other basic consumptions, quick and efficient refund.

The Joint Revenue Board of Nigeria (Establishment) Bill, inter alia, seeks to reestablish the Joint Tax Board and Tax Appeal Tribunal to make them vibrant and address some of the constitutional and fundamental administrative issues arising from the existing legal order and undertake a more focused and effective tax amnesty.

In sum, analysts have said the reform appears to be the most audacious and comprehensive in the annals of fiscal reforms in Nigeria.

Historical context of the current and proposed VAT distribution formula

Prior to VAT’s replacement of sales tax (a state tax), VAT revenue was meant mainly for the states while the federal government was supposed to keep 10 per cent as the cost of collection.

Overtime, the federal government gradually increased its share to the detriment of the states and eventually brought in the local governments in the sharing formula, a development which favoured states with more local governments.

The unrelenting pushback by disadvantaged states led to the adoption of the derivation formula in the VAT revenue distribution in 1999.

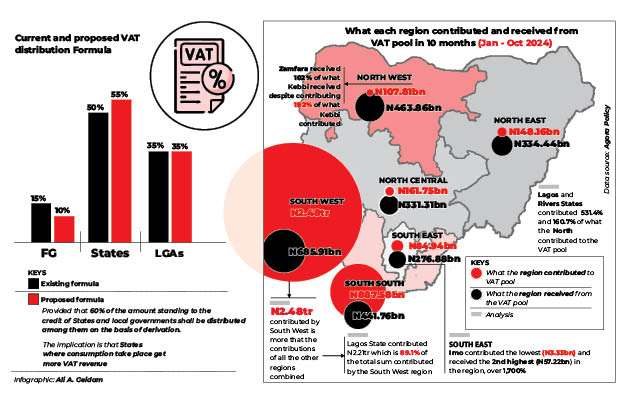

The current position on the distribution of VAT revenue is contained in section 40 of the VAT Act, which provides: (a) 15 per cent to the federal government; (b) 50 per cent to the state governments and the Federal Capital Territory, Abuja; and (c) 35 per cent to the local governments.

The current tax reform initiative seeks to make VAT a federal-only administered tax by amending the constitution to expressly insert it and the consumption tax in the Exclusive Legislative List.

Also, the tax bills proposed adjusting the formula for VAT revenue distribution as follows: (a) 10 per cent to the federal government; (b) 55 per cent to the state governments and the Federal Capital Territory; and (c) 35 per cent to the local governments – “provided that 60 per cent of the amount standing to the credit of states and local governments shall be distributed among them on the basis of derivation.”

The tipping point is the ‘geometric increment’ of the percentage of derivation by 40 per cent from 20 per cent to 60 per cent.

The implication, Weekend Trust gathered, is that states where consumption takes place get more VAT revenue.

Analysts have argued that while it is certain that no state would get exactly what it is receiving now in the post-reform era, the reality, however, is that as the cake gets bigger, the gulf between the top and the lowest will get wider.

We’ll fight the tax bills – Zulum

The governor of Borno State, Professor Babagana Umara Zulum, has said that lawmakers from northern Nigeria would be mobilised to oppose the tax reform bills.

Zulum said the law would devastate the northern region of the country while boosting the economy of Lagos State.

In an interview with the BBC, the governor of Borno State said it was not right for the government to push lawmakers to hasten their approval of the bill.

He said they were worried that the proposal is being rushed into action.

Governor Zulum, who pointed out that there were some bills in the past that took years to be deliberated upon, wondered why there’s so much haste to pass the tax reforms bills.

‘Bills should be subjected to public debate’

Also speaking on the issue, Senator Muhammad Tahir Monguno, during an interview on the BBC Hausa, said, “There are some good things in the bill, which I have spoken in support of like the zero tax on food items, medicine, and workers, who earn less than the new national minimum wage. These are all good. He, however, added that the bills should be subjected to a public debate by Nigerians.

Oyedele speaks

The chairman of the PFPTRC, Taiwo Oyedele, has, on various occasions reeled out some key points about the tax reform bills. He disclosed changes to the income tax laws to facilitate remote work opportunities for Nigerians in Nigeria within the global business process outsourcing. This, according to him, will empower youths to play a key role in the digital economy space.

He said the committee proposed a zero-rated VAT and other incentives to promote exports in goods, services and intellectual property.

“There are tax exemptions for small businesses with annual turnover of N50 million or less, including withholding tax, value added tax, and 0 per cent corporate income tax rate. It also proposed an exemption from personal income tax (PAYE) for minimum wage earners and reduced tax burden for over 90 per cent of all workers in the private and public sectors, as well as VAT at 0 per cent for food, education, health care and exemption for rent, public transportation, fuel products, and renewable energy. These items constitute an average of 82 per cent of household consumption and nearly 100 per cent for low-income households to ameliorate the rising cost of living for the masses,” he said.

He also spoke about the introduction of a tax ombudsman to advocate an improved tax system and protect vulnerable taxpayers, among others.

Responding to the concern of northern governors, Oyedele said: “This issue, in fact, affects many states across all geopolitical zones because the current derivation is mainly determined based on where VAT is remitted rather than where goods or services are supplied or consumed.

“Our proposal aims to create a fairer system by devising a different form of derivation, which takes into account the place of supply or consumption for relevant goods and services, whether they are zero-rated, exempted or taxable at the standard rate. For example, a state that produces food shouldn’t lose out just because its products are VAT-exempted or consumed in other states. The state where the supply originates should be recognised for its contributions. The same principle should apply to services like telecommunications—VAT distribution should reflect where subscribers are located.

“We will collaborate with all stakeholders to address this concern, with a view to finding a balanced solution that achieves a win-win outcome for all.”

‘Derivation-based model for VAT not against the North’

An official of the Federal Inland Revenue Service (FIRS), Aderonke Bello said the proposed tax reform bills, regarding the shift to a derivation-based model for VAT distribution, would not negatively impact the 19 northern states.

“A localised VAT model values the strengths and contributions each region brings to the country and ensures that these efforts benefit local communities directly. It is a way to support each state’s growth and allow funds collected within a state to have a greater impact on its residents.

“I understand your concern, but the new bill will help in developing the region into a prosperous North if you look inward in line with the following: It will strengthen North the more to focus on some of the things they have the comparative advantage of and make them stronger; it will make the North to be more creative in developing what it has instead of relying on other sections of the country for progress and development; it will also make the North look into their abilities and capabilities to develop themselves,” she said.

North not the only region kicking against the tax bills – Prof. Dogarawa

A professor of accounting at the Ahmadu Bello University (ABU), Zaria, Ahmad Bello Dogarawa, in an interview with Weekend Trust said: “I really don’t think the North is the only region kicking against the tax bills. We don’t hear many people attacking the reform from the other regions, maybe due to either politics or lack of information, but I can confirm to you that I have read a number of analyses, rebuttals and criticisms against the reform by many professionals and intellectuals, including professors, especially from the South-East. So, it is not a regional or tribal thing, it affects the whole country.”

He said people attributed the rejection and rebuttals to the North because northern governors made an open declaration on the matter.

Items under VAT exemption

The Ministry of Finance issued the Value Added Tax (Modification Order) 2020, which clarifies and expands the list of VAT-exempted goods as per amendments made by the Finance Act 2019, including an exemption for basic food items.

The order provides that basic food items refer to agro and aqua-based staple foods, including honey, bread, cereals, such as maize, rice, wheat, millet, barley, oats and others supplied as grain, flour etc.

The list also includes cooking oils, such as vegetable oil, soya oil, palm oil, olive oil and others suitable for culinary purposes, fish of all kinds, flour and starch, such as corn flour, plantain flour, cassava flour, bean flour, rice flour and others.

Others are fruits, meat and poultry, milk, nuts, pulses, such as beans, lentils, peas, chickpeas, tamarinds and others; roots such as yam, cocoyam, sweet and Irish potatoes, water-yam, cassava, and others. Also accommodated are salt, vegetables and water.

However, the order clarifies that the exemption does not apply when such basic food items are sold in restaurants, hotels, eateries, lounges and other similar premises, or sold by contractors, caterers and other similar vendors.

The order also provides that VAT exemption applies for baby products made for the use of children from birth to 36 months; plant, machinery and equipment purchased for the utilisation of gas in downstream petroleum operations; educational books and materials; healthcare-related equipment, services and medicine, including for veterinary care, but excluding cosmetology and fitness devices, spas and gymnasium and similar services; shared passenger road transport services for public use, rental of residential accommodation by persons other than corporate entities, petroleum products, including aviation and motor fuels, kerosene, natural gas and other liquefied petroleum gases and gaseous hydrocarbons, wind and solar-powered generators and other renewable energy equipment.

Unanswered questions: What can the North do to benefit from the bills? How can the bills be amended to ensure that no region is shortchanged? What happens to areas that VAT is not applied to from the North? For instance, the North produces grains like beans, sorghum, rice and various fruits, as well as meat, which are highly consumed across the country, especially in the South, but which are not VAT-able. How will the North be compensated for such?

What group of persons will not be taxed under the new law? What level of loss by a company is exempted from tax? Why is the Presidency rushing the process of passing the tax reform bills? Why is it not allowing a nationwide consultation on the matter as President Tinubu suggested after the NEC rejected the proposals? Why is the presidential committee reluctant to publish details of what each state is currently earning from VAT? Why won’t the presidential committee produce and publicise details of its projections on what each state would collect from VAT after the passage of these reform bills?

Answering these and many more questions on the lips of millions of Nigerians, particularly those who have raised their voices in opposition to the proposed reform legislations, appear to be the easiest way to douse the tension so far created by the Presidency’s seeming hasty move, and hopefully see to the passage of the bills.