In a bid to meet the December 31, 2019 deadline for them to achieve the 65 per cent minimum loan-to-deposit ratio (LDR) stipulated by the Central Bank of Nigeria (CBN), banks have adjusted downwards their lending and deposit rates.

The review was also attributed to the recent decision by the central bank banning individuals and local firms from investing in both its primary and secondary Open Market Operations (OMO) auctions.

THISDAY had reported on Monday that average monthly deposit rate was about four per cent. But findings as of wednesday showed that some banks have further lowered their average monthly deposit rate to about three per cent.

On the other hand, findings showed that average monthly lending rates for banks’ consumer banking products is about two per cent.

In fact, some commercial banks have notified their customers of their downward review of interest rates considering market realities.

For instance, Standard Chartered Bank Nigeria in a notice to its customers wednesday, informed them that “following current market realities, please note that effective December 27, 2019, interest rate on our E-saver account would be adjusted as follows: 4.5 per cent placement on N10, 000,000 and above; 4.25 per cent for between N1,000,000 and N9,999,999; and 4.05 per cent for savings between N1 and N999,999.”

The bank therefore urged customers to take advantage of other investment alternatives that may provide them with higher yields and returns, which it listed as treasury bills; FGN Bonds and mutual funds.

Commenting on the development in the money market, an analyst at Ecobank Nigeria, Mr. Kunle Ezun, said the market was awash with liquidity.

However, he expressed optimism that many banks would beat the deadline.

“As I speak to you, my bank (Ecobank) currently has 68 per cent LDR, which is above the stipulated amount. We are even looking at 70 per cent because we all know that is where the CBN is going. But beyond the fact that the central bank is trying to encourage banks to lend, we need to be mindful of the industry non-performing loans (NPLs).

“I am very sure that a lot of banks are careful not to create bad loans in the course of trying to beat deadline so that the gains that had been recorded with industry NPLs now about 6.6 per cent is not wiped out.

“But on the strength on this, the impact of this policy on the economy is going to be very positive. The idea is to drive Gross Domestic Product growth and reflate the economy. Granting loans to individuals and SMEs, is one of the unquestionable ways of jump-starting the economy. For me, this LDR policy is a step in the right direct for the CBN and the banking sector,” Ezun added.

The central bank recently signalled its intention to further raise the LDR to 70 per cent before the end of next year.

At the end of September, which was the deadline to meet its 60 per cent target, it had penalised banks that lagged behind then.

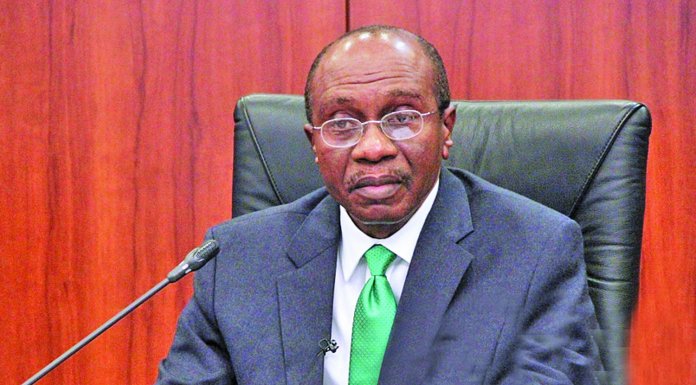

CBN Governor, Mr. Godwin Emefiele, recently predicted a 2.5 per cent Gross Domestic Product for Nigeria in the fourth quarter of 2019, up from the 2.28 per cent achieved in the third quarter.

He also said in the coming year, the banking sector regulator would support greater economic growth, price and exchange rate stability by taking some measures.

He said in 2020, the current tight stance was expected to continue in the near-term, especially in view of rising inflation expectations, noting that the bank would continue to act to appropriately adjust the policy rate in line with unfolding conditions and outlooks.

Source: ThisDay Live

Leave a comment