The Family Homes Funds Limited (FHFL) has identified acceptable collateral structures and/or options, acceptable land titles, options for delivering off-take assurance, and pricing and tenure as the biggest barriers to obtaining funding for the nation’s affordable housing provisions.

This was made known at a Housing Roundtable jointly organized by the FHFL and the Nigerian-British Chamber of Commerce.

According to FHFL, finding solutions to the problems that are causing the blockages will help unleash affordable and sustainable funds for the provision of homes.

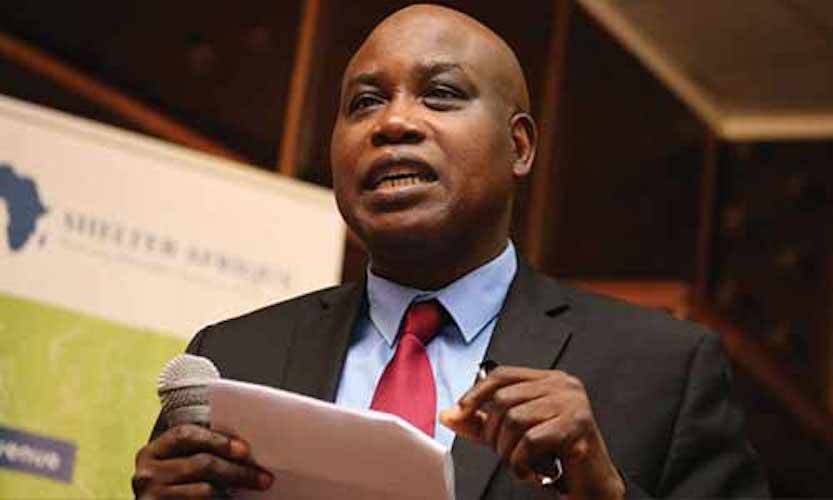

Managing Director/Chief Executive Officer of FHFL, Femi Adewole, while speaking at the occasion, noted that the blockages also had an impact on the supply and demand sides of the nation’s housing delivery.

Adewole, however, said the target of the company was to provide finance for housing schemes across the country, adding that FHFL aims to deliver 500,000 homes by the end of 2022.

Based on available data, he noted that eight out of ten Nigerians are without a decent home.

He noted that it would be challenging to ignore the data if housing is to be inclusive, citing earlier statistics from the president of the NBCC.

According to him, given the current circumstances, it has become clear that citizens could no longer rely on the government to meet their housing needs but to go for the expansion of the economy.

In order to improve its working relationship with developers in order to provide financing for the provision of affordable homes, the FHFL boss said the organization is looking for partners.

“Mortgage partners are available on the demand side. The low-income population makes up another link in the value chain. We are investigating rental properties. Although the youth might not have an affinity for home ownership, we are prepared to collaborate with organizations to provide rental homes”, he said.

He said that in order to attract funding, he said it was necessary to expand the market, while also creating a supportive environment for housing development to thrive.

Adewole pointed out that the majority of construction materials are imported from China, which accounts for their high price.

He claimed that FHFL is already working with the Nigerian Building and Road Research Institute (NBRRI), regional door manufacturers, and other parties to reduce the cost of materials to deliver affordable homes.

Also sharing some thoughts on the financing of affordable housing in Nigeria, Co-founder/Managing Director, Alitheia Capital, Jumoke Akinwumi, supported Adewole’s view of broadening the market and ensure the creation of an enabling environment to attract funds.

Although she acknowledged the existence of both public and private capital, she emphasized the necessity of educating housing stakeholders about the definition of affordable housing, available options, and sources of funding as well as how to aggreagte them.

She asserts that the market’s participants should start considering novel funding products rather than sticking with conventional ones.

She added that potential applicants must package their products to speak the financing language and that they must explore universal funding.

“The funds are there; the bulk of work is with us. You need to look at your products. Investors want to invest, they just want to see the products.

“Until we have the market that is transparent, we will continue to strangulate yourselves.”

Other participants at the Housing Roundtable suggested that, in addition to good land titles like Certificates of Occupancy (C of O), development on the land; equity contributions by partners; leaseholds of housing development partners; guarantees from cooperative groups; and accessing the cash-flow of potential buyers with a consistent income stream should serve as collateral.

Additionally, they noted that C of O was not accepted as collateral by the financial institutions due to delays in land documentation, corruption on the part of government officials, and the issuance of two different titles on a single plot of land.

They called for the establishment of a Central Land Registry at the federal level, with each state also being required to establish one in order to facilitate easy access by developers, investors, and financial institutions.